D

Deleted member 18588

Guest

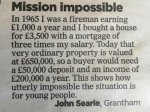

Which I fear is where we are today - a place we as a country were not some 50yrs ago.

Romanticised rubbish!

Society is no more or less selfish now than it was 50 years ago.

To some extent the older generation have always regarded the young as reckless and the young have resented the old.

The preconceived notions have existed since time began.

BTW I can remember 1968, not certain that some others can.