Mudball

Assistant Pro

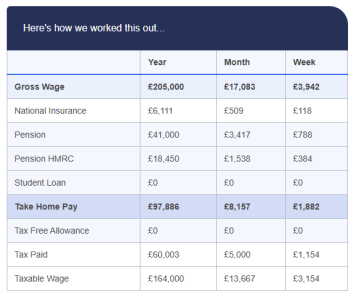

Here you go... if I change this to 20% into Pension. Assume company matches upto 10%.. so about 60k into pension..Don't know TBF, but you can make up to 60k per year pension contributions so that leaves some scope if outgoings allow.

Then you are left with 97k or about 8.5k per month. That is a tough choice.

Someone on 200k+ will have outgoings to match. If you are in london then that is even tighter. Avg private education is about 20-30k per child per year from post tax salary. 2k of mortgage is another 24k. So a single child + mortgage will eat more than half your post tax salary.

Add another child and outgoings, now you are walking a tight rope or dependent on partner's income. (PS: lets not argue pvt education and life choices).

So the comparative post still stands.. we as a nation are not doing enuf to attract or retain talent and wealth.